Understanding the No Credit Check Rental Market

Source: helpforfelons.org

No credit check house for rent – The market for “no credit check” rental properties caters to a specific segment of renters facing challenges with traditional credit-based screenings. Understanding this market requires examining the typical renter profile, rental rates, and common lease terms.

The Typical No Credit Check Renter, No credit check house for rent

Source: ebayimg.com

Renters seeking properties without credit checks often include those with limited or damaged credit histories. This can encompass individuals new to the rental market, those recovering from financial hardship, or those with past credit issues. The demographics are diverse, but often include young adults, recent immigrants, or individuals experiencing temporary financial instability.

Demographics and Rental Rates

While demographics vary, young adults, recent immigrants, and individuals with inconsistent employment histories are more likely to seek no-credit-check rentals. Rental rates for these properties generally fall within a range comparable to or slightly higher than those requiring credit checks, reflecting the increased risk for landlords. The premium varies based on location, property condition, and market demand.

Terms and Conditions of No Credit Check Leases

Leases for no-credit-check rentals often include stricter terms and conditions to mitigate landlord risk. These may involve higher security deposits, shorter lease terms, and more stringent requirements for income verification and rental history. Landlords may also require co-signers or guarantors.

Pros and Cons of No Credit Check Rentals

A balanced perspective requires considering the advantages and disadvantages for both landlords and tenants. The following table summarizes these key aspects:

| Feature | Tenant Pros | Tenant Cons | Landlord Pros | Landlord Cons |

|---|---|---|---|---|

| Access to Housing | Easier access to housing for those with poor credit | Potentially higher rents and stricter lease terms | Higher occupancy rates, potentially filling vacant units faster | Increased risk of tenant default and higher vacancy costs |

| Financial Flexibility | May be a solution for those facing temporary financial difficulties | May need to provide additional documentation or a co-signer | Faster tenant placement | Greater due diligence required, increased administrative burden |

| Lease Terms | May find shorter lease terms available | May face limitations on lease renewal | Flexibility in lease terms | Higher risk of property damage |

| Security Deposit | May need a larger security deposit | May experience difficulty securing a lease | Financial protection against potential damages | Increased financial risk if tenant defaults |

Landlord Perspectives and Practices

Landlords renting without credit checks assume significant risks, necessitating alternative assessment methods and robust security measures. Understanding these practices is crucial for both landlords and prospective tenants.

Risks and Mitigation Strategies

The primary risk is tenant default, leading to lost rental income and potential legal costs. Landlords mitigate this by thoroughly verifying income, employment history, and rental history. They may also require larger security deposits, shorter lease terms, or co-signers. Regular property inspections are another crucial aspect of risk mitigation.

Alternative Tenant Assessment Methods

Beyond credit scores, landlords rely on income verification (pay stubs, bank statements), rental history (references from previous landlords), and employment verification. Background checks can also reveal criminal history, providing an additional layer of security.

Security Measures and Tenant Attraction Strategies

Security measures include robust lease agreements with clear terms, regular property inspections, and readily available communication channels for addressing tenant concerns. Attracting responsible tenants involves clear advertising, detailed screening processes, and competitive but fair rental rates. Offering well-maintained properties is also a significant factor.

Sample Lease Agreement Clause

A lease agreement should explicitly state the lack of a credit check and detail the alternative assessment methods used. It should also clearly Artikel the tenant’s responsibilities, including timely rent payments, property maintenance, and adherence to lease terms. A sample clause might state: “While a credit check was not performed, the Landlord has verified the Tenant’s income and rental history as detailed in Appendix A.

The Tenant agrees to abide by all terms and conditions of this lease agreement.”

Tenant Considerations and Responsibilities

While no-credit-check rentals offer accessibility, tenants should understand the associated challenges and responsibilities. Proactive steps can significantly improve their chances of securing a lease.

Advantages and Disadvantages for Tenants

The primary advantage is increased access to housing, particularly for those with credit challenges. However, this often comes with higher rents, stricter lease terms, and the need to provide extensive documentation to demonstrate reliability. Tenants should weigh these factors carefully.

Finding a no credit check house for rent can be challenging, but options exist. If you’re looking in the Laramie area, you might find suitable properties by checking out available listings like those on this site: laramie houses for rent. Remember to carefully review the specific requirements of each landlord, as no credit check policies vary significantly even within the same location, ensuring you understand the complete terms before signing a lease.

Challenges and Demonstrating Reliability

Tenants might face challenges securing a lease without a strong credit history. To demonstrate reliability, they should provide comprehensive documentation of income, employment history, and rental history, along with references from previous landlords or employers. Open communication and transparency with the landlord are also crucial.

Documentation and Essential Steps

Essential documentation includes pay stubs, bank statements, employment verification letters, and letters of recommendation from previous landlords. Before signing a lease, tenants should carefully review all terms and conditions, understand their responsibilities, and seek clarification on any unclear aspects. A checklist should include verifying the landlord’s legitimacy, inspecting the property thoroughly, and obtaining a copy of the signed lease agreement.

Legal and Ethical Implications

Navigating the legal and ethical aspects of no-credit-check rentals is crucial for both landlords and tenants. Understanding fair housing laws and potential legal pitfalls is paramount.

Legal Requirements and Regulations

Legal requirements vary by jurisdiction. Some areas have specific regulations regarding tenant screening and discrimination. Landlords must comply with fair housing laws, ensuring they don’t discriminate based on protected characteristics. Tenants should also be aware of their rights and responsibilities under local tenant laws.

Legal Pitfalls and Ethical Considerations

Source: forrentnocreditcheck.com

Potential legal pitfalls include discrimination lawsuits and lease violations. Ethical considerations involve balancing the need for housing accessibility with responsible landlord practices. Transparent communication and fair treatment are essential for both parties.

Fair Housing Laws and Decision-Making Process

Fair housing laws prohibit discrimination based on race, color, national origin, religion, sex, familial status, or disability. Landlords must apply consistent screening criteria to all applicants, regardless of credit history. A landlord’s decision-making process should be documented and justifiable, demonstrating adherence to fair housing principles.

Landlord Decision-Making Flowchart

A flowchart illustrating a landlord’s decision-making process would begin with the application review, proceed to income and rental history verification, and conclude with a decision to approve or deny the application based on established criteria. Each step would involve a documented assessment of the applicant’s suitability.

Finding and Securing a No Credit Check Rental

Securing a no-credit-check rental requires a strategic approach, utilizing available resources and understanding the application process.

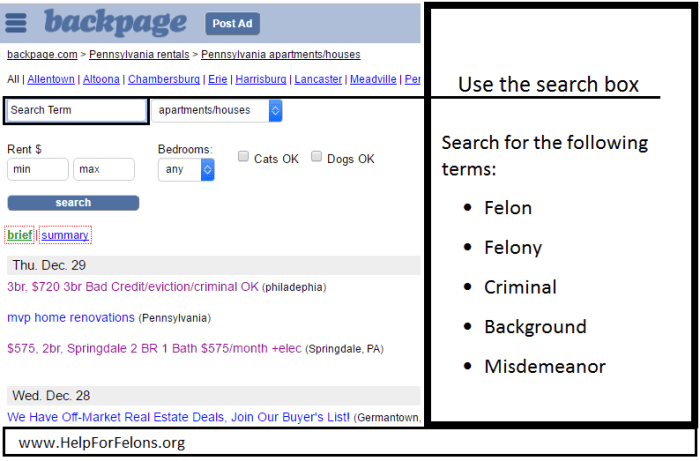

Resources and Application Process

Tenants can search for no-credit-check rentals through online listing platforms, local real estate agents specializing in this market, and by directly contacting property management companies. The application process usually involves submitting an application form, providing supporting documentation (income verification, rental history), and potentially undergoing an interview.

Documentation and Negotiation

Tenants should prepare documentation such as pay stubs, bank statements, employment verification, and rental references. Negotiating lease terms might involve discussing rent, security deposit, lease duration, and other conditions. Open communication is key to reaching a mutually agreeable agreement.

Step-by-Step Rental Process Guide

A step-by-step guide would include: 1. Identifying potential properties; 2. Contacting landlords or property managers; 3. Completing applications and providing documentation; 4. Attending property viewings; 5.

Negotiating lease terms; 6. Signing the lease agreement; and 7. Moving in.

Popular Questions: No Credit Check House For Rent

What documentation should a tenant provide if they have limited credit history?

Tenants with limited credit history should provide extensive proof of income (pay stubs, tax returns, bank statements), rental history (previous lease agreements), and employment verification.

Can a landlord legally refuse a tenant solely based on a lack of credit history?

While landlords can consider credit history, refusing a tenant solely based on its absence may violate fair housing laws in some jurisdictions. They must justify their decision based on other factors demonstrating tenant reliability.

What are the typical lease terms for no credit check rentals?

Lease terms may be shorter, and landlords might require larger security deposits or co-signers to mitigate risk. Specific terms vary greatly depending on the landlord and property.

Where can I find resources to help me find a no credit check rental?

Specialized rental websites, local real estate agents familiar with this market, and direct contact with property management companies are good starting points.